BluSmart is India’s first all-electric shared smart mobility platform, operating on a business-to-consumer (B2C) model. Customers directly pay for electric taxi services via the BluSmart mobile application. The company leases its electric vehicles from institutional partners like Energy Efficiency Services Limited (EESL) to manage costs, as purchasing EVs outright can be expensive. BluSmart also invests in building its charging infrastructure, ensuring efficient operations and a seamless customer experience.

In contrast, traditional taxi aggregators like Ola and Uber typically partner with individual taxi owners or drivers, providing a platform for ride bookings and charging a commission per ride. This model reduces the need for these companies to own vehicles or employ drivers directly.

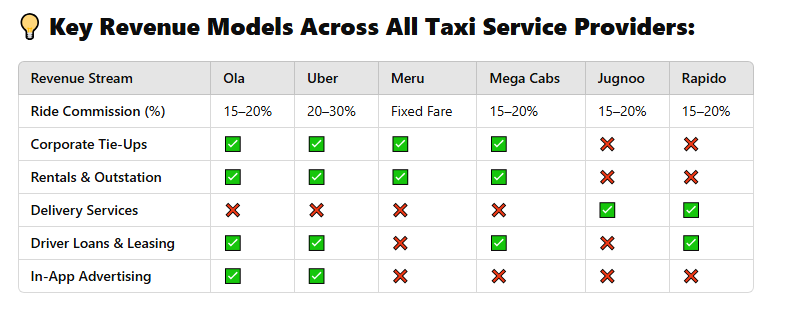

The taxi aggregator business model in India is dominated by key players like Ola, Uber, Rapido, and regional operators like Meru, Savi, Mega Cabs, and Jugnoo. Each operates under the aggregator model, connecting drivers (partners) with passengers via mobile apps, but with slight variations.

Here’s a comprehensive breakdown:

Emerging Trends:

- EV Adoption: Ola Electric and Uber Electric for eco-friendly rides.

- Logistics Expansion: Rapido and Jugnoo are expanding into e-commerce delivery.

- Regional Growth: Regional players like Savi and Fast Track are expanding beyond metro cities.

- Corporate Mobility: Increased demand for business transportation solutions.

- Fixed commission: Fixed day-wise commission over variable commission per ride.

BluSmart’s approach differs by owning and operating its electric vehicle fleet, including vehicles like the Mahindra e-Verito, Tata e-Tigor, and Hyundai Kona Electric. They planned to have greater control over service quality and sustainability. Its Unique Selling Proposition revolves around its commitment to sustainability, technology-driven solutions, and a premium, eco-friendly transportation experience. It leased electric vehicles from its partners & hired drivers on a salary basis.

But this asset-heavy business model involves higher operational costs, such as vehicle leasing and establishing charging infrastructure. This is the main root cause for significant challenges that threaten its operations and growth prospects.

Operational and Financial Struggles

The company is grappling with a substantial reduction in daily rides, which have fallen to less than half of the 25,000-30,000 rides per day it achieved at its peak last year. This decline is largely due to Gensol Engineering’s decision to divest approximately 3,000 electric vehicles (EVs) previously leased to BluSmart, following a debt repayment crisis. Without Gensol’s support, BluSmart’s operational costs have increased, further straining its financial stability.

Compounding these issues, key executives, including the CEO, Chief Business Officer, Chief Technology Officer, and Vice President, have resigned, leading to concerns about the company’s strategic direction and leadership stability.

Challenges in Fleet Expansion

BluSmart’s ambitious goal to deploy 100,000 EVs by 2025 has been scaled back to 10,000 due to difficulties in sourcing vehicles. The limited availability of suitable EVs from manufacturers has hindered the company’s ability to expand its fleet, affecting service availability and growth plans. BluSmart’s fleet is significantly smaller compared to established competitors like Uber and Ola. This disparity leads to longer wait times and limited availability, especially during peak hours. Consequently, customers often face difficulties in securing rides promptly, leading to dissatisfaction.

Customer Experience Concerns

Users have reported dissatisfaction with BluSmart’s policies, particularly the requirement to pre-load funds into the app’s wallet for ride bookings. Customers are frustrated by the inability to withdraw unused funds and the imposition of cancellation charges, leading some to label the app as a scam.

Limited Fleet Size and Availability: BluSmart’s fleet is significantly smaller compared to established competitors like Uber and Ola. This disparity leads to longer wait times and limited availability, especially during peak hours. Consequently, customers often face difficulties in securing rides promptly, leading to dissatisfaction.

2. Higher Fare Structure: While BluSmart avoids surge pricing, its fares are 10-20% higher than those of competitors. This pricing strategy can deter price-sensitive consumers, especially when more affordable options are readily available.

3. Service Reliability Concerns: There have been reports of unreliable service experiences with BluSmart. For instance, customers have reported issues such as drivers being unable to locate pick-up points, leading to cancellations and delays. Additionally, instances where drivers have demanded additional payments despite receiving the agreed fare have raised concerns about the company’s service reliability.

4. Driver Management and Support Issues: Drivers have expressed dissatisfaction with BluSmart’s management practices, citing concerns about low earnings, stringent policies, and inadequate support. Complaints include issues like arbitrary penalties, lack of grievance redressal mechanisms, and perceived unfair treatment. Such challenges can affect driver motivation and, by extension, the quality of service provided to customers.

5. Customer Support Limitations: Some customers have reported delays and inadequate responses from BluSmart’s customer support. For example, complaints regarding driver misconduct or service issues have not been addressed promptly, leading to frustration among users.

These factors contribute to consumers’ perceptions that BluSmart’s services may not consistently meet their expectations in terms of availability, affordability, and reliability, thereby limiting its broader adoption in the competitive Indian ride-hailing market.